+1 604-285-1886

KATHERINE SUN CPA INC.

Resources

Staying current is important for our business and yours. These tax publications and resources are provided for your use. If there is information or issues that you need clarified, don’t hesitate to contact us.

Tax rules announced in Budget 2018 will require more trusts to file returns and all trusts to report more information. Proposed legislation that significantly expands trust reporting requirements was first introduced in 2018, for taxation years ending on or after December 31, 2021. While those proposals were not enacted to law, additional proposed legislation on these requirements was introduced on February 4, 2022 and most recently, on August 9, 2022. The new regime will require most trusts to file a T3 Trust Income Tax and Information Return annually for tax years ending on or after December 31, 2022, including trusts that have never filed before. In addition, all affected trusts will be subject to enhanced reporting requirements.

The primary purpose of these amendments is to increase transparency regarding beneficial ownership and assist the Canada Revenue Agency (CRA) in properly assessing the tax liabilities for trusts and their respective beneficiaries. According to the government, there are significant gaps in the information it currently collects about trusts through the tax system. The new rules are intended to close these gaps in line with other steps the government is taking to address tax evasion, money laundering and other financial crimes.

Current reporting rules

Under current rules, a trust must generally file a T3 return for a tax year if the trust has tax to pay for the year or the trust disposes of a capital property, or the trust distributes all or part of its income or capital to its beneficiaries. The return must be filed within 90 days after the end of the trust’s tax year. No T3 return is currently required from trusts that are inactive or have no income or tax payable. In addition, trusts that are required to file a T3 return do not have to identify all of the trust’s beneficiaries.

New reporting rules

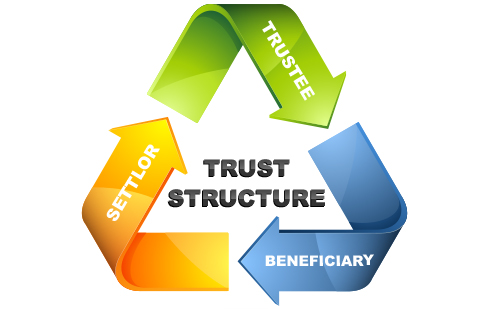

For taxation years ending after December 30, 2022 (basically 2022 and later tax years), the new reporting requirements would apply to “express trusts” that are resident in Canada and to non-resident trusts that are currently required to file a T3 return. An express trust is generally a trust created with the settlor's express intent, usually made in writing. Most personal trust residents in Canada will now be required to file an annual return even where there is no income tax liability and the trust made no distributions or allocations during the year. In addition, as part of the February 4, 2022 draft legislation, subsection 150(1.3) of the Income Tax Act was proposed, which will subject so-called bare trust arrangements to the new reporting rules.

Limited exceptions continue to be provided for trusts which:

have been in existence for less than three months at the end of the year; or

hold less than $50,000 in assets throughout the taxation year (provided that their holdings are confined to cash, certain debt obligations and listed securities)

Some types of trusts are exempt from the proposals, including:

trusts that have existed for less than three months

trusts that hold less than $50,000 in assets throughout the tax year (as long as they only hold deposits, government debt obligations and listed securities)

mutual fund trusts, segregated funds and master trusts

trusts where all the units of which are listed on a designated stock exchange

trusts governed by registered plans, including proposed first home savings accounts

employer profit sharing plans

lawyers’ general trust accounts

graduated rate estates and qualified disability trusts

trusts that qualify as non-profit organizations or registered charities

employee life and health trusts

certain government-funded trusts

cemetery care trusts and trusts governed by eligible funeral arrangements

Enhanced reporting Requirements

Under the proposed regulations, every trust that must file a T3 return must disclose information which includes the name, address, date of birth, type and classification of entity, jurisdiction of residence and taxpayer identification number, such as social insurance number, trust account number, business number or taxpayer identification number used in a foreign jurisdiction for each:

trustee;

beneficiary;

settlor and;

each person who has the ability (through the terms of the trust or a related agreement) to exert influence over trustee decisions regarding the appointment of income or capital of the trust.

Non-compliance penalties

The current penalty for not filing a T3 return when required will continue to apply. It will also apply if the required additional information on Schedule 15 is not included with the return. The penalty is $25 for each day late, with a minimum penalty of $100 and a maximum of $2,500.

The new rules also impose a significant additional gross negligence penalty where a failure to file the return was made knowingly or due to gross negligence. The additional penalty would be five per cent of the maximum value of property held by the trust during the relevant year, with a minimum penalty of $2,500. This penalty would also apply to false statements and omissions amounting to gross negligence as well as a failure to respond to a CRA demand to file.

Please contact us with any questions about the new reporting rules.